Is it too late to establish a 2021 retirement plan?

- Matthew Avery

- Jan 27, 2022

- 1 min read

In years prior to 2020, owner-only businesses had to establish and adopt a self-directed solo 401(k) before the end of the business year, based on the fiscal year for the company. The Secure Act provides more time for owner-only businesses to establish a plan.

With the passage of the SECURE Act (Setting Every Community Up for Retirement Enhancement) which was made law in late December 2019, owner-only employers can now adopt the solo 401k plan by their business tax return due date plus business tax return extensions. Basically, the solo 401k plan establishment deadline is now based on the business tax return due date instead of the business tax year end.

The Reason for the Change

The purpose of this extension to open the solo 401k plan is to give owner-only businesses more time to determine if a solo 401k plan is right for them. The increased deadline to open a solo 401k plan now aligns with the SEP IRA establishment deadline.

Sole Proprietorship or C-Corporation

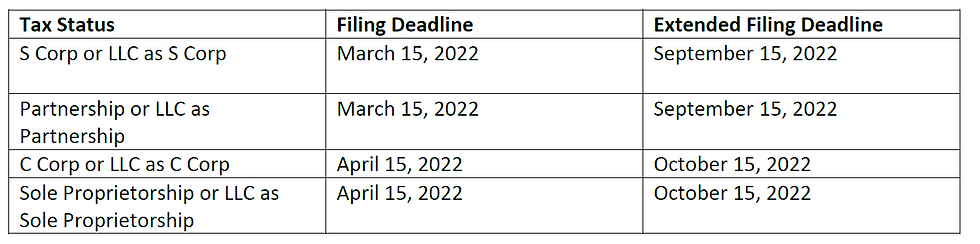

A business’ tax filing deadline depends on the business type (e.g., sole proprietorship, partnership, LLC, S-corporation, or C-corporation). For example, if your self-employed business entity type is a sole proprietorship or C-corporation, and you want to establish a solo 401k plan for the 2021 tax year, you can wait to open the solo 401k plan by October 15, 2022.

Partnership or S-Corporation

If your self-employed business is a partnership or S-corporation, the 2021 solo 401k plan establishment deadline is September 15, 2021. The following chart outlines the year 2021 solo 401k establishment deadline by entity type and tax status:

Comments